How Should I Start Investing Without Basic Experience?

Europeans are becoming more active in the capital markets thanks to the development of digital technologies. Today, every adult European can explore investment alternatives, get advice, and invest money online. However, the household investment rate remains lower than the savings rate:

- According to Eurostat estimates [1], in December 2024, the investment rate among households was 8.81% (with a maximum of 9.99% in 2022).

- At the same time, the savings rate among households in the EU was 14.02% (with a maximum of 26.9% in 2020).

This data indicates that more Europeans now prefer to save than invest. However, in the second case, they can receive a significant increase in their capital.

Fear of losing their money and inexperience keep many potential investors from the opportunity to earn passive income. The difficulty is that no one explained what to know before investing. Many think: How should I start investing without a deep knowledge of financial laws? Still, to become a successful investor, studying Finance at university or completing special courses is unnecessary. Following the advice of professionals, you will find out all the things to know about investing.

Thus, you can master this type of financial activity yourself. The main thing is not to risk large amounts of money right away. First, make sure that you consider all the risks and make the right choice at each stage of investing. In this article, we will introduce you to the very initial or preliminary stage of investing. Following these tips, you will create ideal starting conditions for placing your capital in any type of asset.

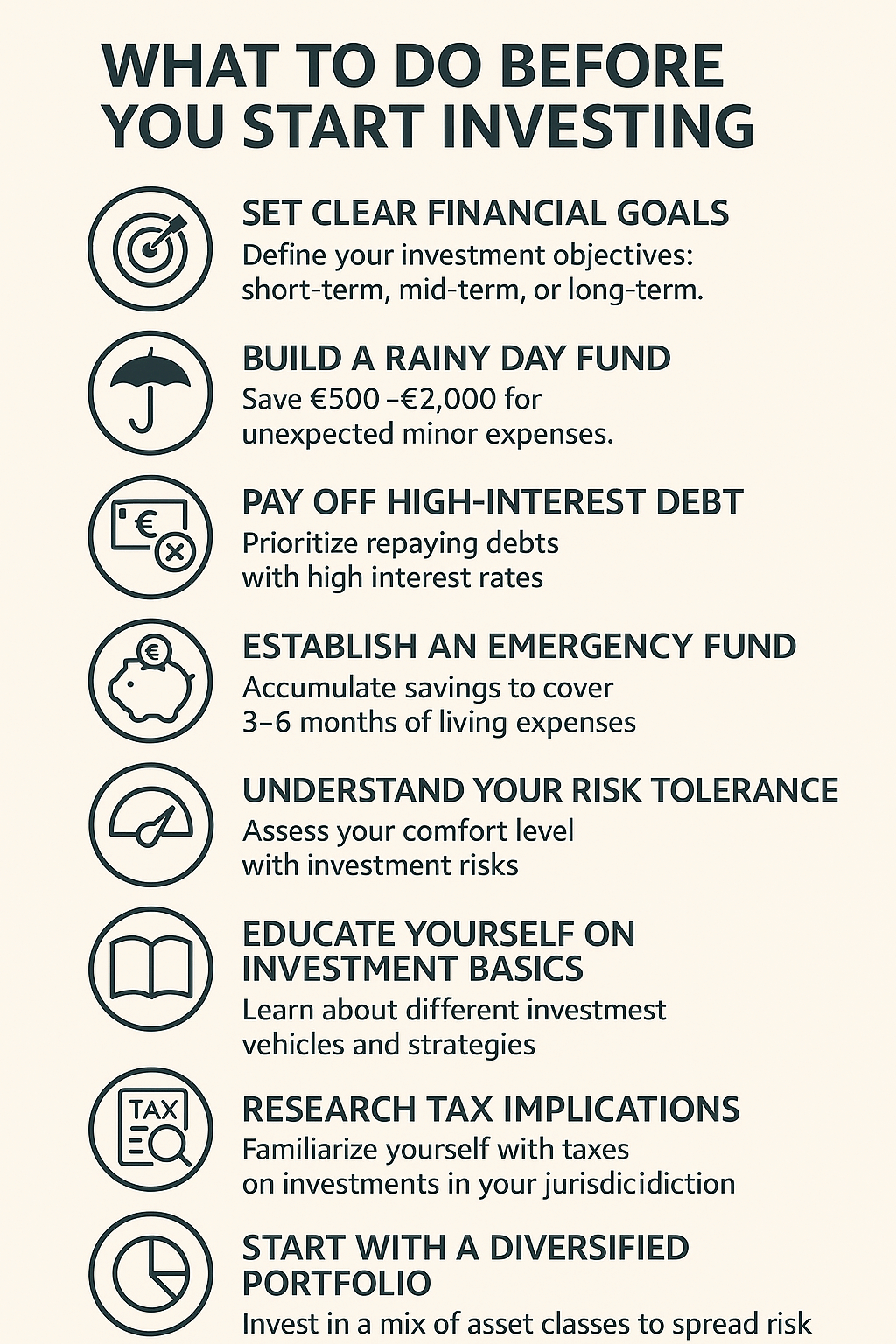

Set Financial Goals & Create a Roadmap

Motivation is the main driver of investing, so people with strong motives get involved more quickly. They don’t even need to come up with some other goal, since the existing one pushes them to find an additional source of income. A person may want to open a business, move to a better area, travel, etc. Such investors know how much money they need and what they will spend it on.

But there are other types of novice investors. They come to this type of activity to protect their money from inflation and invest it in assets that will give them a profit. In this case, they need to define their financial goals and aspirations more clearly. Without a strong motive, they risk getting less from their investments than they could.

Having clearly defined your goals, you will understand what type of investment will suit you best. Short-term, mid-term, and long-term goals [2] require different approaches to investing. So, only by defining them can you build an effective roadmap.

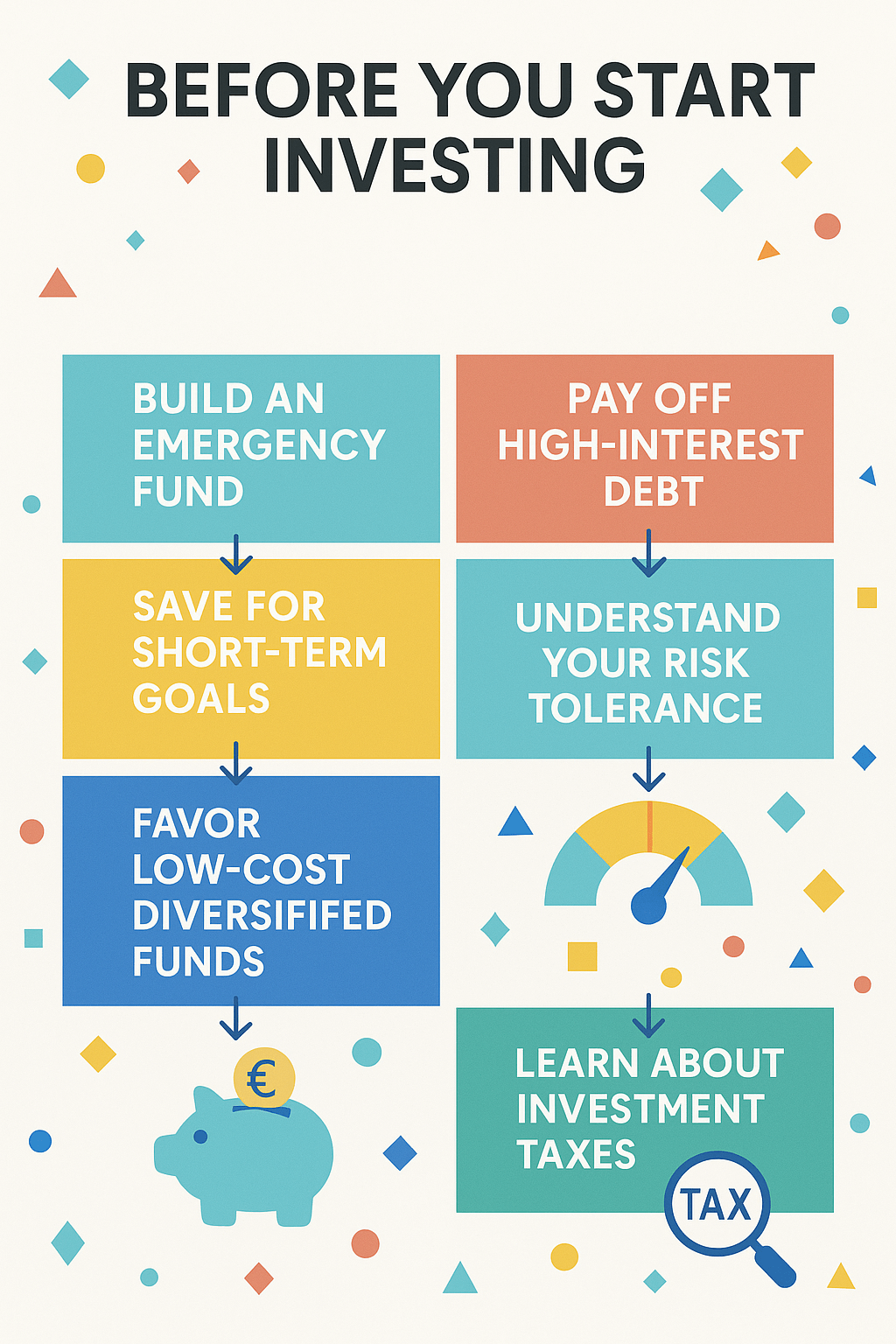

Build a Rainy Day Fund

You shouldn’t invest if you’re not confident you can handle unexpected challenges and twists of fate. A broken car, health problems, unforeseen repairs, or moving can easily knock a person off their feet without savings. However, these troubles won't be critical if you’ve taken care of a rainy day fund.

These savings differ from the emergency fund in that they are significantly lower. For the latter, you must collect an amount covering 3-6 months’ living expenses. And in the rainy day fund [3], having 500 to 2,000 euros is enough. This amount will cover minor expenses without resorting to the money you’ve invested.

Pay Your High-Interest Debt

Outstanding loans can be a significant burden on your budget, especially at high interest rates. You shouldn't take risks and invest money in any projects if you have such loans. If you violate the repayment schedule, the debts will multiply. The profit from investments will not be able to cover them. Therefore, if you have extra cash and debts, use this money to pay off the debt [4]. And only then start investing.

Have Adequate Savings for Short-Term Goals

Many novice investors wonder: Should I start investing without enough savings? Taking money out of your investment account to cover short-term needs is not rational. In this case, you will not be able to earn the profits you expected. Therefore, you must accumulate adequate savings to protect yourself and your investments.

Define Your Risk Tolerance

Risk is one of the key factors for investments to generate profits. As a rule, low-risk investments provide low profits. However, the risk of losing them is also small, which is appealing to conservative investors. Such investments include buying real estate, certificates of deposit (CDs), municipal and corporate bonds, precious metals, etc.

High-risk investments have the potential to yield much higher returns. However, the probability of losing at least part of your capital on such investments is also significant. Moreover, the profit may not be as substantial as you expected. Such types of investments [5] include currency and cryptocurrency trading, high-yield bonds, securities crowdfunding, venture capital, options, futures, real estate investment trust (REITs), etc.

There are also risk-free investments that guarantee a future return. However, their low rates of return attract only those who simply want to protect their money from nominal losses. However, such investments cannot guarantee that the purchasing power of your capital will be preserved. This type of investment includes government treasury securities, inflation-indexed bonds, cash in the case of short-term investment horizons, etc.

4 levels of risk and types of assets for investments

| Risk Level | Type of Investor | Type of Investments | Expected Return |

|---|---|---|---|

| Very Low | Cautious investors who avoid risk. | Government bonds, savings accounts | Safe with minimal returns, typically matching inflation. |

| Low to Medium | Open to some risk for better returns. | Corporate bonds, real estate, fixed annuities | Moderate gains with occasional value changes. |

| Medium to High | Willing to risk capital to increase profits. | Cryptocurrencies, international markets | Higher potential returns with a risk of losses. |

| Very High | Speculative investors seeking large profits. | Startups, junk bonds, exploration ventures | Very high profits or total loss of investment. |

Choosing Assets That Match Your Risk Appetite

When novice investors approach financial advisers, they ask about "everything I need to know about investing." However, professionals first try to learn about their clients' risk appetites. Many factors influence the choice of asset type for investment, including the investor's willingness to accept a possible loss of profit or invested capital. This is called risk tolerance. It may differ depending on what part of your capital you invest, how confident you are in your ability to react to all market turbulence, etc. Low-risk investments do not require increased attention to all changes in the market, while high-risk ones require you to monitor them closely. Therefore, the investor must decide on several important questions:

- How much time are they willing to devote to analyzing the market situation?

- How critical is the loss of the invested amount for them?

- What are the chances of success of the given investment?

And depending on their answers to these key questions, they should choose the type of asset for investment.

Diversification as a Main Way to Reduce Risks in Investing

The main problems with investing arise when market changes go against your expectations. This is not everything you need to know about investing, but it is a crucial point. In such a case, investors can lose profits and investments. However, not all assets react the same way to certain market shocks. Therefore, the most effective mechanism for protecting them is diversification of the investment portfolio. There are different types of investment portfolio diversification [6]:

- Invest in issuers operating in different jurisdictions.

- Build an investment portfolio from different types of assets: gold, stocks, futures, raw materials, etc.

- Invest in different sectors of the economy.

- Those who prefer to buy currencies or crypto should form a portfolio from different types of fiat currencies or crypto.

- It is also worth combining short-term, medium-term, and long-term investing.

- Don't work with just one broker; choose several reliable ones.

Be Thorough with Your Research and Due Diligence

Another important mechanism for protecting your investments is comprehensive due diligence [7]. It differs from a superficial study of available information about a project or assets. As a rule, information analysis is carried out in several stages:

- Obtaining initial information about a project or assets.

- Assessing how much they correspond to your investment strategy.

- Estimating the potential benefit of this investment.

- Making a decision in favor of this deal.

- Launching comprehensive due diligence.

Thus, due diligence is the last link in this chain of collecting and analyzing information about the object and making a decision. This procedure may require certain expenses. And if you decide to abandon this investment at the preliminary stages, you can save money.

Don't Rely on Tips or Predictions

Don't follow publicly available advice on buying stocks, currencies, bonds, etc. Sometimes they can go into detail about things to know before investing. However, experts are not responsible for the advice they offer to the general public. Therefore, if you lose capital on their advice, you will only have yourself to blame for your gullibility. Moreover, they may act in someone else's interests to manipulate the market or advertise some projects or assets. Therefore, rely on your comprehensive research or seek advice from trusted paid financial advisors. They will tell you what to consider before you invest based on a personalized approach. Thus, they will take into account all your personal circumstances.

When in Doubt, Stick to Reliable Assets

Where should I start investing if I'm too busy to get into all the details? If you do not have time to analyze and constantly monitor the market, you should not invest in high-risk assets because they require constant attention. Choose reliable investments that will not bring large profits, but will not put your capital in the risk zone. In this case, you may not worry about the fate of your investments because you can be sure of a guaranteed, albeit small, profit. This is called passive investing since it does not require active participation on your part.

Learn Basic Fundamental Analysis Before Picking a Stock

Researching only the assets you are going to buy is not enough to succeed in investing. Their value over time is affected by the overall market situation. You will need knowledge of fundamental and technical analysis to predict its state and reversals. Still, if you are not going to engage in active trading, you can master only the first of them. To conduct fundamental market analysis and make correct forecasts, read financial statements, study key economic indicators, follow political news, etc. They will show you everything to know about investing in specific assets or projects.

Compare Costs & Fees Before You Invest

To really grow your money and not enrich your broker or other intermediary, carefully study all the costs and fees of investing. Investment fees directly affect your returns, so always consider them before making the final decision. If a broker promises a 9% average annual return, and its services and all sorts of fees total to 2%, you will receive only 7% of the return. Therefore, when comparing different options for placing investments, take this factor into account.

How Will You Track and Manage Your Investments?

The method of monitoring investments depends on the assets you have acquired. Here are the main methods that apply to many of them:

- Study semi-annual and annual reports.

- Browse websites that offer statistics and analyze the performance of your assets.

- Use the information that your broker offers on its platform.

- Monitor asset prices yourself.

To make tracking and managing investments convenient, use special apps. They offer various portfolio analysis and risk assessment tools. Relying on them, you will save on financial advisors' advice.

Tax Implications of Your Investments

The tax landscape of different European countries varies, which can be confusing for an inexperienced investor. You should carefully study the tax laws of your jurisdiction to invest responsibly. Taxes also directly influence the return on investment, so the level of investment in different EU countries varies. In most cases, you will need to know the laws of your country regarding the following three types of taxes:

- Personal Income Tax

- Capital Gains Tax

- Net Wealth Tax

However, not all countries will require you to pay all three taxes to invest. For example, many countries do not require net wealth taxes, which can make them more attractive for investment activities.

Summary

Investing is fundamentally different from saving, although both types of financial behavior are better than wasting money. Investing gives you the opportunity to build wealth with your own money because it can grow if you invest it in profitable assets and projects.

Still, before investing, you need to answer several important questions: When can you start investing? What assets should you invest your money in? What diversification methods should you choose? You should not invest thoughtlessly or trust dubious experts on the Internet. For investments to be successful, you need to prepare for them carefully. Consider market conditions and your preferences. In this case, you will receive profits, not losses. Moreover, if you respect your inclinations and interests, investing will bring you pleasure, not a burden. And the more you are involved in all the circumstances and details of investing, the greater your profit will be.

Frequently Asked Questions

What is a Contingency/ Rainy Day Fund?

A contingency or rainy day fund is a sum of money in a savings account that is kept aside for unexpected expenses or emergencies. It is a financial tool that can help prevent debt and provide financial stability. Contingency funds can be used to cover unexpected expenses, such as car repairs, medical bills, home repairs, and other unplanned costs. They can also be used to protect against potential losses from investments, business downturns, or job loss. Having a contingency fund can help provide peace of mind and protect you from unexpected financial hardships. It is important to make sure you are saving enough to cover at least three to six months of expenses.

How to Estimate Your Risk Tolerance?

Estimating your risk tolerance is essential to investing. There are several factors to consider when assessing your risk tolerance. First, consider your age. Younger investors may be more willing to take risks because they have a longer investment horizon and can recover from losses. Next, review your current financial situation and any debts you may have. If you have a low debt-to-income ratio or a large contingency fund, you may be more willing to take risks. Additionally, think about your emotional state and how you react to a financial loss. This will help you answer if you are comfortable taking risks or do you prefer more conservative investments. By considering these factors, you can get a better sense of your risk tolerance and make more informed investment decisions. It's also important to remember that risk tolerance may change over time, so it's important to re-evaluate your risk tolerance regularly.

What is the Difference Between Active and Passive Investing?

Active investing is when an investor actively buys and sells investments like stocks, bonds, or mutual funds. It involves making decisions about which investments to buy and sell, and when to do so. Passive investing, on the other hand, is when investors use a “buy and hold” strategy and make fewer decisions about their investments. They purchase investments, such as index funds, and then hold onto them for a long period of time instead of actively trading them.

Are all Investment Returns Taxed at the Same Rate?

No. Assets such as stocks, bonds, mutual funds, real estate, and business investments may all be subject to different taxes depending on their specific structure and the country in which they are located. For example, in some European countries, capital gains from stocks are taxed at a lower rate than income from a job or business. Similarly, depending on the jurisdiction, dividends from mutual funds may be taxed at a higher or lower rate than rental income from real estate investments.

List of References

- Source: ec.europa.eu

- Source: investopedia.com

- Source: bankrate.com

- Source: investopedia.com

- Source: investopedia.com

- Source: bankrate.com

- Source: investopedia.com